The Bill of Sale document bears a resemblance to the Minnesota Notification of Assignment form due to its role in documenting the transfer of ownership, albeit of personal property rather than a security interest. While the Bill of Sale evidences a clear transfer of ownership from seller to buyer, the Notification of Assignment similarly records the transfer or release of a security interest in a vehicle among parties. Both documents play a crucial role in ensuring legal clarity regarding the rightful ownership or interest in the registered property or vehicle.

A Lien Release Form shares a key similarity with the Notification of Assignment through its function in officially releasing a party’s claim or interest on an asset, following the fulfillment of the terms agreed upon. Just as the Notification of Assignment can release a secured party’s interest in a vehicle when the security agreement is satisfied, the Lien Release Form removes the lienholder's claim, thus clarifying the asset's title and ownership status. Both forms are essential in updating and clarifying the legal status of the property or vehicle involved.

The Mortgage Assignment Form, often used in real estate transactions, parallels the Notification of Assignment by facilitating the transfer of an interest in property. However, instead of vehicle-related interests, it concerns real estate mortgages. Similar to how the Notification form reassigns a secured party's interest in a vehicle, the Mortgage Assignment allows lenders to transfer mortgage obligations. This ensures that all parties’ rights and responsibilities are clearly documented and recognized by law.

The UCC-1 Financing Statement is another document that aligns with the aspects of the Notification of Assignment, particularly in its purpose of notifying interested parties of a secured interest in personal property or fixtures. The difference lies in the broader application of the UCC-1, which can apply to various assets beyond vehicles. Both documents serve to publicly declare the existence of an interest, protecting the rights of the secured parties under respective state laws.

The Security Agreement itself shares foundational similarities with the Notification of Assignment form, as it establishes the initial agreement giving rise to a secured interest. While the Notification of Assignment can serve to assign, release, or grant this interest with respect to an already established agreement, the Security Agreement specifies the terms under which the interest is provided, including collateral description and repayment conditions. In essence, the Notification acts on the framework the Security Agreement establishes.

The Vehicle Title Transfer form has a direct correlation with the Minnesota Notification of Assignment, especially when a lien is involved in the transfer process. Both documents are instrumental in the vehicle’s title process, ensuring that any security interest is appropriately accounted for during the transfer of ownership. While the Title Transfer formally changes the owner of the vehicle, the Notification of Assignment clarifies the status of any secured interests associated with the vehicle, supporting a smooth and legally sound transition.

Lastly, the Promissory Note, while primarily a financial document outlining the details of a loan’s repayment, intersects with the intent behind the Notification of Assignment form by potentially necessitating the use of such a notification should the note be secured by an interest in a vehicle. In cases where a vehicle acts as collateral for a loan, the assignment or release of the secured interest as per the terms of the Promissory Note would require formal documentation through a similar process as outlined in the Notification of Assignment.

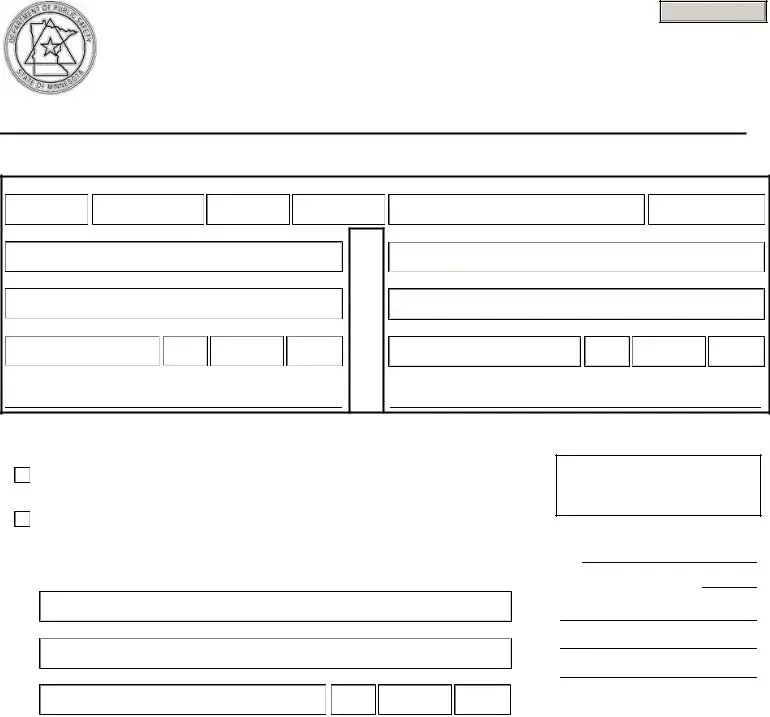

ASSIGNMENT The secured party named in Section A has assigned his interest to the secured party named in Section B.

ASSIGNMENT The secured party named in Section A has assigned his interest to the secured party named in Section B.