The Uniform Business Office Application (UBO4) is quite similar to the Minnesota ST101 form as both are used by businesses to provide comprehensive information about their operations. While the ST101 focuses on determining sales tax nexus within Minnesota, the UBO4 is often used in healthcare settings for billing purposes. Both forms require detailed business information, including identification numbers and types of business activities.

Another analogous document is the Combined Registration Application used in various states. This application, similar to the ST101, gathers detailed information about a business for the purpose of state tax registration, covering aspects like sales tax, employer withholding, and unemployment insurance. Both forms serve as a point of entry for businesses to comply with state tax obligations.

The Secretary of State (SOS) Business Entity Filing form also shares similarities with the ST101. This form is used to register or update information about a business entity, including its name, principal office address, and type of business, much like the ST101 form, which collects detailed business information to assess tax nexus.

The Vendor Responsibility Questionnaire parallels the ST101 in its objective to gather comprehensive information about a business, albeit for the purpose of assessing a vendor's responsibility and integrity in public procurement processes. Both require detailed disclosures about the business operations, ownership, and financial status.

The W-9 Form, Request for Taxpayer Identification Number and Certification, is simpler but still similar to the ST101 in the aspect of requiring a business to provide its legal name, tax identification number, and certification regarding its tax status. Both forms are critical in the context of tax administration and compliance.

The Business License Application forms, which vary by jurisdiction, resemble the Minnesota ST101 form as well. These applications often require detailed business information to ensure compliance with local licensing and regulatory requirements, similar to how the ST101 collects information to ascertain tax obligations in Minnesota.

The Foreign Qualification Filing for businesses operating in states other than their state of incorporation echoes aspects of the ST101, with both requiring disclosure of business activities and operational details in a jurisdiction to determine compliance obligations, including tax nexus and authority to operate.

The Annual Report filings required by many state corporations' divisions share the objective of gathering periodic business activity information. Like the ST101, these reports are crucial for maintaining active business status and compliance with state regulations, including tax matters.

The Employee’s Withholding Allowance Certificate (W-4) focuses primarily on employee tax withholding, yet it can be seen as similar to the ST101 in terms of facilitating tax compliance. Both collect crucial information used in the determination and fulfillment of tax responsibilities.

Lastly, the Sales and Use Tax Permit Application forms, required for businesses to collect sales tax on taxable sales, share a common purpose with the ST101. They both play a role in the tax administration process by collecting business details relevant to tax obligations and compliance within a specific jurisdiction.

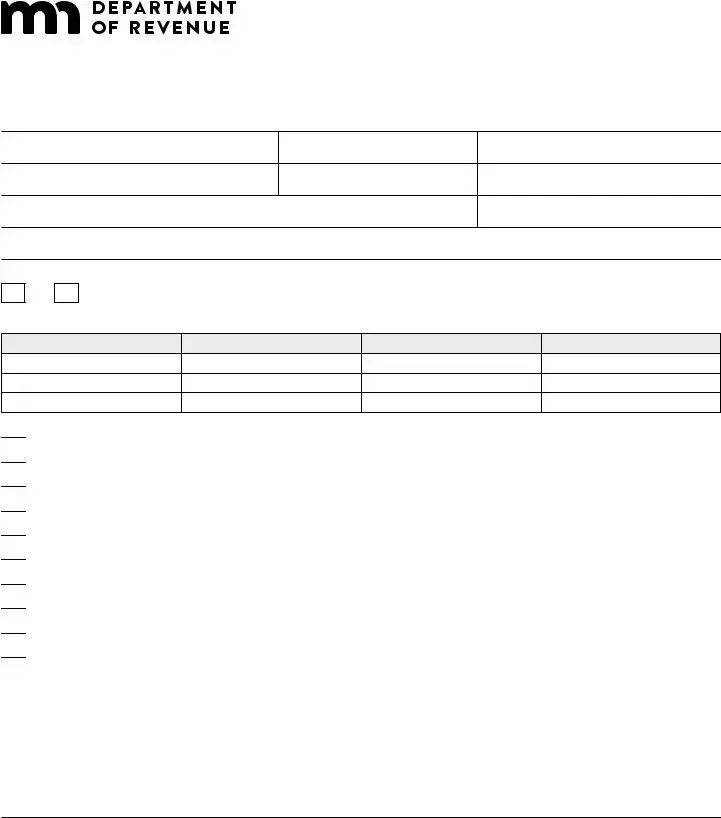

Facilitates the sale of taxable goods or services to customers in Minnesota on behalf of a business

Facilitates the sale of taxable goods or services to customers in Minnesota on behalf of a business

Sells products to customers in Minnesota, using the internet, mail order, or telephone, without having physical presence in Minnesota

Sells products to customers in Minnesota, using the internet, mail order, or telephone, without having physical presence in Minnesota

Owns property or maintains a physical location in Minnesota (office, warehouse, or distribution, sales, or sample room)

Owns property or maintains a physical location in Minnesota (office, warehouse, or distribution, sales, or sample room)

Has an employee, representative, agent, or independent contractor working on your behalf in Minnesota

Has an employee, representative, agent, or independent contractor working on your behalf in Minnesota

Provides services in Minnesota

Provides services in Minnesota

Delivers items into Minnesota in its own vehicles

Delivers items into Minnesota in its own vehicles

Has displays at conventions or trade shows in Minnesota

Has displays at conventions or trade shows in Minnesota

Keeps inventory in a fulfillment center in Minnesota

Keeps inventory in a fulfillment center in Minnesota

Is an affiliate of a Minnesota retailer that promotes or provides other services to you and your business and the retailer are related parties

Is an affiliate of a Minnesota retailer that promotes or provides other services to you and your business and the retailer are related parties

Has an agreement to pay a commission or similar consideration to a Minnesota resident who directly or indirectly refers potential buyers to your business through website links or otherwise

Has an agreement to pay a commission or similar consideration to a Minnesota resident who directly or indirectly refers potential buyers to your business through website links or otherwise