The Minnesota M1 form, specifically the Schedule M15 section for 2012, serves as a critical document for individuals calculating their underpayment of estimated income tax. It outlines a detailed process for determining if a penalty for underpayment is applicable, offering...

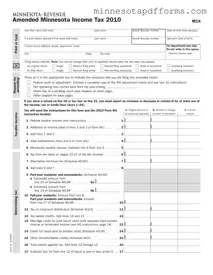

The Minnesota M1X form is designed for individuals who need to amend a previously filed Minnesota income tax return for the year 2010. It is essential for correcting errors or making adjustments to one's tax return after it has already...

The Minnesota M30 form is a mandatory state tax document that mining companies operating within Minnesota must complete annually to report and pay the occupation tax based on their income and deductions related to mining operations. It encompasses various sections,...

The Minnesota M4NP form is designed for tax-exempt organizations and cooperatives that file federal Form 990-T or 1120-C, allowing them to claim a net operating loss deduction. It provides a detailed account of net operating losses, showing how losses from...

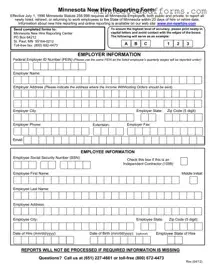

The Minnesota New Hire Reporting Form is a crucial document mandated by Minnesota Statute 256.998 since July 1, 1996, requiring all Minnesota employers to report new hires, rehires, or employees returning to work within 20 days. This process helps in...

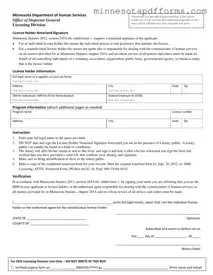

The Minnesota Notarized Form is a crucial document designed by the Minnesota Department of Human Services, Office of Inspector General, Licensing Division. It serves the important function of capturing the notarized signature of an individual or non-individual license holder, which...

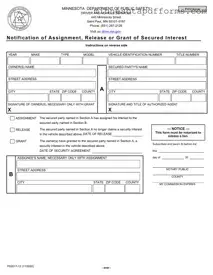

The Minnesota Notification of Assignment form is a crucial document for transferring a secure interest in a vehicle. It serves three main functions: notifying of an assignment, releasing, or granting a secured interest in accordance with the procedures laid out...

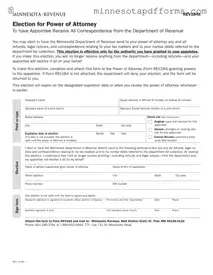

The Minnesota form, specifically known as REV184a Election for Power of Attorney, is a document that enables individuals to elect a power of attorney (appointee) to receive all refunds, legal notices, and correspondence from the Minnesota Department of Revenue on...

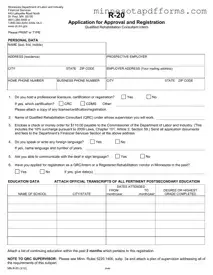

The Minnesota R 20 form is a crucial document for individuals aspiring to become Qualified Rehabilitation Consultant Interns under the Department of Labor and Industry's supervision. It requires personal data, detailed educational background, employment history, and specific licensure or certification...

The Minnesota ST101 form, known as the Minnesota Business Activity Questionnaire for Determining Sales Tax Nexus, is a comprehensive questionnaire designed for businesses to ascertain their tax obligations within the state. By collecting detailed information on a company's activities, including...

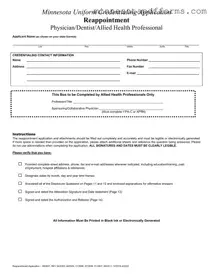

The Minnesota Uniform Credentialing Application is a comprehensive form designed for physicians, dentists, and allied health professionals seeking reappointment credentials in Minnesota. It requires detailed information about personal data, professional training, practice history, and affiliations with hospitals or other health...

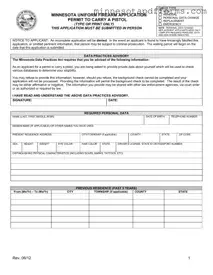

The Minnesota Uniform Firearm Application Form is a critical document for individuals seeking to legally carry a pistol in Minnesota, including options for new permits, renewals, personal data changes, replacements, and emergency situations. It mandates that applicants provide detailed personal...